Current Offers Available

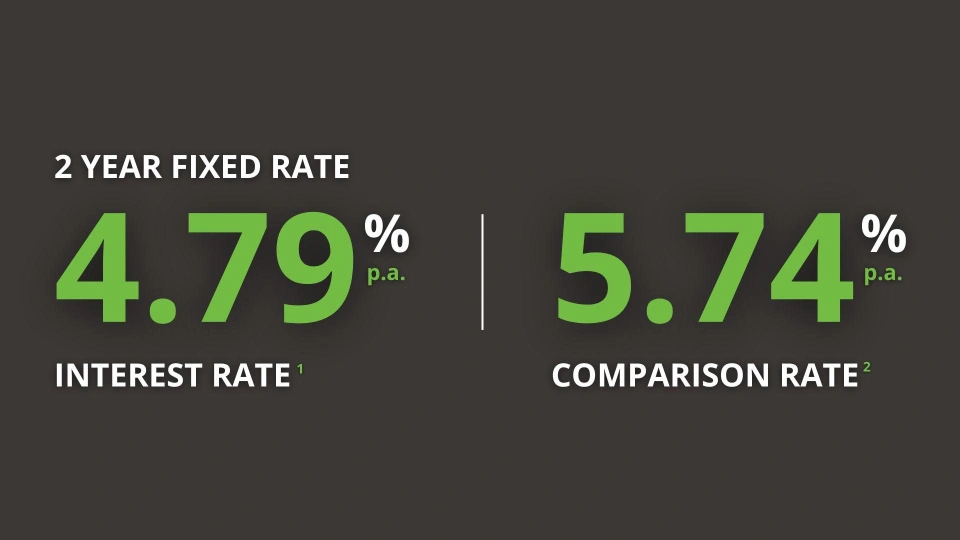

Lock in a Competitive Rate – 2-Year Fixed from 4.79%!

Secure a 2-year fixed rate from just 4.79% with Vie and enjoy the peace of mind knowing exactly what your repayments will be.

✔ Fixed repayments for easier budget management

Take the next step with Vie! Speak to a Vie Advisor today to explore your options.

Terms, Conditions & Eligibility Criteria

1. Discounted rate is only available for Personal/Owner Occupied loans taken out as part of the Home Package Plus >= $150,000 and borrowings <= 80% of the security property value (LVR) inclusive of lenders mortgage insurance (if applicable), Principal and Interest repayments. The discounted rate (currently 4.79% p.a.) is calculated by subtracting a discount of 0.45% from the Standard 2 Year Fixed Rate (currently 5.24% p.a.) and only applicable while the loan remains in the Home Package Plus. At expiry of the 2 Year Fixed Rate Term, the loan will revert to the applicable Standard Variable Rate advertised at the time (currently 8.48% p.a.) less the Home Package Plus discount (currently 2.97% p.a.). The Standard 2 Year Fixed Rate applicable on the day of settlement of the loan will be used to calculate the applicable discounted fixed rate unless the rate has been secured by paying a Guaranteed Rate Fee, which must be selected at time of loan application. Current standard fixed rates and discounts are subject to change without notice. Pre-approvals excluded. The discounted rate is available on eligible loans applied for from 22 August 2025. Home Package Plus Annual Fee - $375 annual package fee will be charged and reimbursed while package is active. Savings based on 30-year loan term. Offer subject to change.

2. This comparison rate is based on $150,000 over a term of 25 years and incorporates certain fees and charges that are applicable for the chosen product. WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. Comparison rates for Interest Only Fixed Rate home loans are based on an initial Interest Only period equal in length to the fixed rate period. Comparison rates for Interest Only Variable home loans are based on an initial 5 year Interest Only period.

Refinance Fast. Settle Sooner!

FASTRefi® is a streamlined refinancing solution designed to get you settled sooner - giving you access to your new loan in days, not weeks.

✔ No extra cost compared to a standard refinance

✔ Faster access to your new loan terms and funds

Ready to move forward?

Speak with a Vie Advisor today and explore your refinance options.

^Terms, Conditions & Eligibility Criteria

^Loan suitability for FASTRefi® is assessed in line with the relevant lender requirements. FASTRefi® is supported by an authorised insurance provider and is subject to specific eligibility criteria.

Conditions, fees, and charges may apply. All credit applications are subject to lender approval and lending criteria. This information is general in nature and does not consider your personal objectives, financial situation, or needs. You should assess whether it is appropriate for you and read all relevant disclosure documents, including the Terms and Conditions, before making a decision.

FASTRefi® is a registered trademark of First American Title Insurance Company of Australia Pty Limited. FASTRefi® is available through select lenders and is subject to eligibility and lender approval. Speak to your Vie Advisor to explore whether FASTRefi® is available for your refinance.

Vie Brisbane North

Vie Launceston

Vie Burnie

Vie Devonport